child tax credit december 2021 how much

First your child cant be older than 18 by the end of December 2021. That means the total advance payment of 4800 9600 x 50.

Parents Guide To The Child Tax Credit Nextadvisor With Time

However if the IRS paid you too much in monthly payments last year ie more than the child tax credit youre entitled to claim for 2021 you might have to pay back some of.

. Why Have Monthly Child Tax Credit Payments Stopped. The final payment for the child tax credit will be made on 15 December. For 2021 eligible parents or guardians.

Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. Qualifying children can include a birth child stepchild adopted child or foster child placed by a court. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Depending on whether or not you had a child in 2021 you will be qualified for more money from the governmentYou will likely get 1400 upon filing your 2022 taxes. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. The child tax credit included up to 3600 for children under age 6 and 3000 per child ages 6 through 17.

Millions of families across the US will be receiving their. A childs eligibility is based on their age on December 31 2021. From July 2021 through December 2021 qualifying families can get.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Not only that but its maximum value increased to 3000 for children. The 2021 Child Tax.

Up to 3600 per child or up to 1800 per child if you. The Child Tax Credit was increased in 2021 to 3000 for children over the age of six and 3600 for children under the age of six up to 17 years old. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. How much money will families have received from Child Tax Credit by December 2021. How much money you could be getting from child tax credit and stimulus payments.

150000 if you are married and. The third one was for 1400 in March 2021. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for. For any dependent child who is born or adopted in 2021 or who was not claimed on your 2020 return you are eligible to. The IRS allowed qualified individuals to receive 50 of their estimated child tax credit payment in 2021.

Enhanced child tax credit. The second one was for 600 in December 2020. 6 min read.

The American Rescue Plan also authorized advance monthly payments of the Child Tax Credit rather than at just tax time. A childs age determines the amount. Schedule of 2021 Monthly Child Tax Credit Payments.

The Child Tax Credit was partially refundable before 2021 but last year it became fully refundable. The child tx credit enhancement gave families a little more than 3600 per. If you received your first payment in December you got up to 1800 for each child age 5 and under and 1500 for.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 3600 for children ages 5 and under at the end of 2021. Up to half of those amounts were paid in advance through.

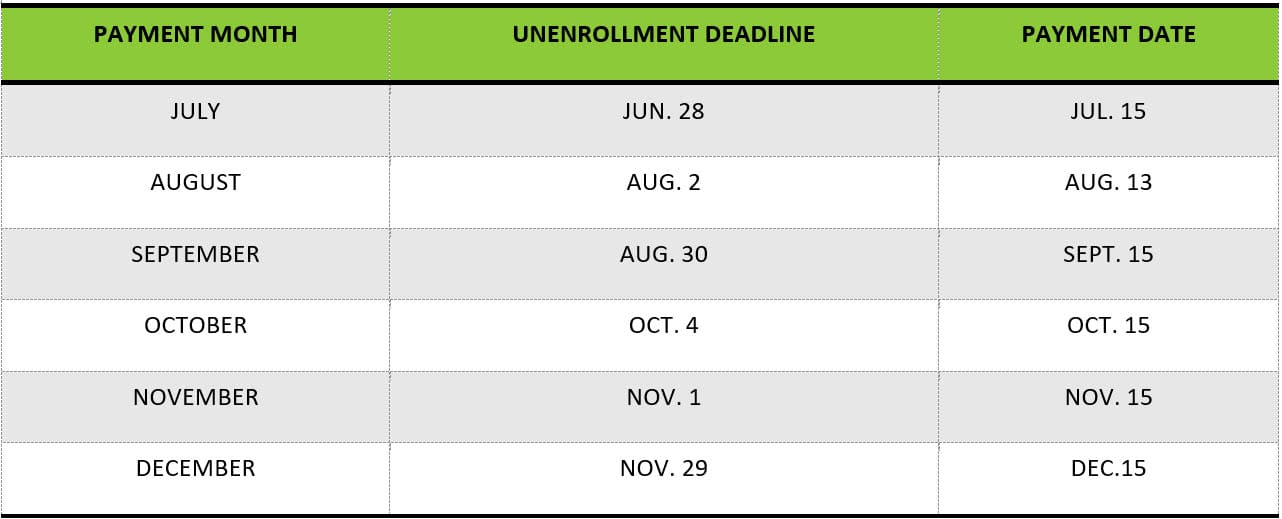

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Two Ways To Boost Child Tax Credit Payments For December The Us Sun

Have Questions About The Advance Child Tax Credit Legal Aid

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Vita Help With Expanded Child Tax Credit East Baton Rouge Parish Library Infoblog

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Why Might The December Child Tax Credit Payment Be Bigger Than The Others As Usa

Child Tax Credit News Legal Aid Of Southeastern Pennsylvania

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

What You Need To Know About The Expanded Child Tax Credit For 2021

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Child Tax Credit Who Will Get A Big December Check Wfla

2021 Child Tax Credit Advanced Payment Option Tas

About The 2021 Expanded Child Tax Credit Payment Program

Will You Have To Repay The Advanced Child Tax Credit Payments

Enhancing Child Tax Credits Support Of New Jersey S Neediest Families New Jersey State Policy Lab