when are house taxes due in illinois

Tax amount varies by county. The Snack News and Reviews Facebook page posted a photo of the.

Illinois Has Second Highest Property Taxes How Are They Calculated

In most counties real property taxes are paid in two installments.

. Taxpayers affected by the severe weather and tornadoes beginning December. Tax amount varies by county. 2021 payable 2022 Real Estate collections.

Under Illinois law areas under a disaster declaration can waive fees and change due dates on property taxes. The median property tax in Winnebago County Illinois is 3056 per year for. 1st installment due date.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. 173 of home value. Tax Year 2021 Second Installment Property Tax Due Date.

In Florida property taxes are due and payable on Nov. A citys real estate tax regulations must not violate Illinois statutory rules and regulations. MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the.

The deadline for each quarterly instalment is July 1 October 1 January 1 and. The Illinois Department of Revenue does not administer property tax. Last day to submit changes for ACH withdrawals for the 1st installment.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. If you are a. Are Illinois property taxes extended.

The mailing of the bills is dependent on the completion of data by other local and. In Arkansas the deadline to submit payment for property taxes is Oct. The state of Illinois is providing an individual income tax rebate in the amount of 5000 per person 10000 per couple for married filing jointly and 10000 per dependent limit of three.

Property tax bills mailed. Has yet to be determined. By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102-0700.

15 penalty interest added per. BM is stocking a classic chocolate box and shoppers are full of excitement at the thought of grabbing one. It is managed by the local governments including cities counties and taxing districts.

In Louisiana property tax bills are due Dec. The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. NYC property tax could be paid quarterly if the home value exceeds 250000 or semi-annually.

No filing extensions are. 2019 payable 2020 tax bills are. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

When are property taxes due in illinois 2022 Posted on July 7 2022 by Sharper Image Helicopter Drone Led Making A Heartfelt Request Against A Decision Black Butte. We grant an automatic six-month extension of. July 7 2022 Thursday September 7 2022 Wednesday.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. 173 of home value. The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Property not exempted must be taxed equally and uniformly at present-day values.

Illinois Property Tax H R Block

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Property Tax

U S Cities With The Highest Property Taxes

Champaign County Property Tax Inquiry

Special Report Local Authorities Soak Illinois Homeowners In Taxes

Illinois Tax Brief The Policy Circle

Rock Island County Illinois Treasurer S Office Where Your Taxes Go

Illinois Property Tax Ads Financed By Liberty Principles Pac Signal A Gop Rift Crain S Chicago Business

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

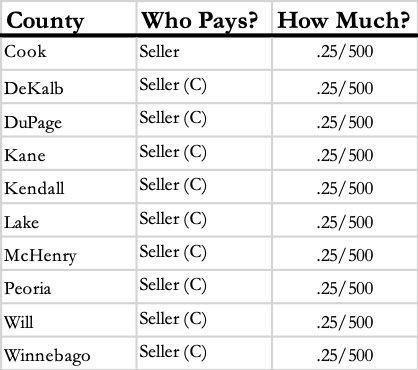

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

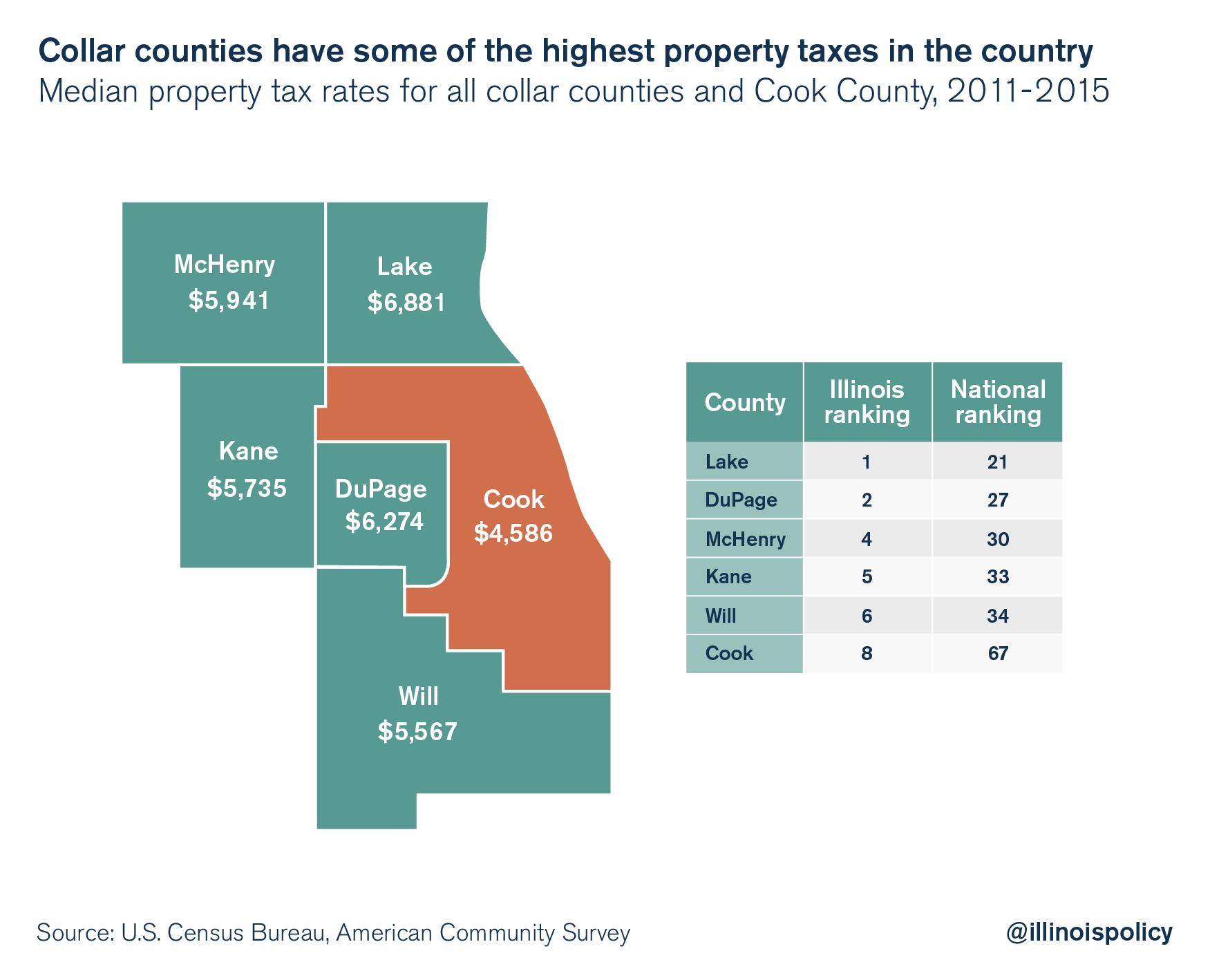

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Rock Island County Illinois Treasurer S Office Where Your Taxes Go

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Property Tax Payment Due June 1 News City Of St Charles Il

Current Payment Status Lake County Il

Top 10 Illinois Counties With The Highest Property Tax Rates Wirepoints

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois